What is Cindicator?

Cindicator fuses together machine learning and market analysis for asset management and financial analytics. The Cindicator team dubs this human/machine predictive model Hybrid Intelligence, as it combines artificial intelligence with the opinions of human analysts “for the efficient management of investors’ capital in traditional financial and cryptomarkets.”

Cindicator’s ecosystem consists of over 50,000 financial analysts with expertise that span across currency, stock, and cryptocurrency markets. These analysts are asked questions through the project’s platform, and their answers are weighted and evaluated using machine learning. The AI then formulates market analysis which members of the Cindicator community can then benefit from through a variety of trading tools.

Community members and forecasters manage their operations using the platform’s app, and the Cindicator company manages asset pooling and funds to compensate its contributors fairly. The company had its ICO in September, which excluded US investors due to regulatory reasons, but its app has been live since 2015.

Currently, Cindicator’s model is only used for market trends and predictions, but as the project’s whitepaper outlines, it has theoretical applications for scientific analytics, corporate and business solutions, and political event predictions.

Now that you’re primed with the bare-bones info, let’s pack on some meat.

How it Works

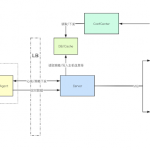

As we briefly reviewed above, Cindicator’s model consists of two main components: human analysis and artificial intelligence. Taken together, Cindicator’s artificial intelligence processes analysts’ predictions to provide its users with more precise event forecasts. In essence, its Hybrid Intelligence looks to harness the intellectual power of man with the computing power of machine learning to deliver more accurate market analytics.

Thus, we may look at Cindicator’s ecosystem as having a trifold structure. Professional analysts provide the groundwork of this ecosystem, artificial intelligence builds a robust product on top of this groundwork, and Cindicator token holders (the community at large) benefit from this work by using the final product.

Part 1: Man

Cindicator’s platform boasts a decentralized community of roughly 52,000 professional and non-professional analysts. These analysts comprise the backbone of Cindicator’s anatomy, without whom the entire body could not function.

Under Cindicator’s system, analysts monetize their intellectual efforts, market analysis, and financial predictions by contributing to the ecosystem. The team dubs this layer of the ecosystem the Collective Intelligence Platform. This platform draws predictions from diverse viewpoints to mitigate subjective or biased forecasts and generic group-think.

In order to collect responses, Cindicator’s app produces a series of daily questions for its analysts. Each analyst is asked questions based on their area of interest/expertise. For example, if you’re a stockbroker using Cindicator, you may see questions like “What will the S&P 500’s price be at the end of the week?” or “Will Netflix’s stock fall below $250 before reaching $255?”. If you’re an active cryptocurrency trader, however, you may get questions like “Will Ethereum’s price fall or rise 10% over the next two days?” or “Will Stellar Lumens enter the top 5 currencies by market cap by the end of the month?”.

Analysts in the Collective Intelligence platform are incentivized to provide their most thought-out, accurate forecasts because correct answers can be rewarded. Ratings can increase or decrease based on prediction accuracy, and all ratings are finalized on a monthly basis. At the end of each month, a cash prize from Cindicator’s funding pool is doled out between the highest rated forecasters of that month. Ratings are then reset going into the next month to place all analysts on an equal competitive footing.

Part 2: Machine

Artificial intelligence processes predictions from the Collective Intelligence Platform. Machine learning (ML) then runs this raw data alongside general market data into thousands of models to more precisely forecast the movements of financial markets.

To do so, the AI measures what’s called the confidence weight of each analyst. This measurement is taken from the collective accuracy and track record of an analyst’s predictions, the profit or loss margin from each forecasted “trade,” and a predictive model that compares prediction likelihood compared to other forecasters. The platform’s machine learning is also dynamic and constantly evolving its models to make the best use of the raw data it collects. This includes testing multiple trading strategies and hypotheses, as well as constantly testing various models to adapt to the ever-changing market.

Essentially, the models that Cindicator’s ML and AI produce can be divided into two categories: superforecasting models and the wisdom of the crowd model.

With the former, Cindicator combines forecasters and their predictions into clusters. To formulate these clusters, the AI groups forecasters based on predictive similarities (e.g. bullish predictions vs. bearish predictions, those who use fundamental analysis vs. those who use technical analysis, etc.). The AI also looks at behavioral patterns in these groups, such as how often an analyst make a mistake or how s/he reacts to a change in market trends.

For the wisdom of the crowd model, Cindicator builds various models using the predictions of all forecasters. This conglomerate analysis is factored into a real-time analysis of market trends, and the robustness of each model is validated via their success rates to weed out the accurate from the inaccurate.

Part 3: The Community

After Cindicator’s AI processes the raw data into its machine learning models, Cindicator token holders can take advantage of the fruits of the Hybrid Intelligence’s labor.

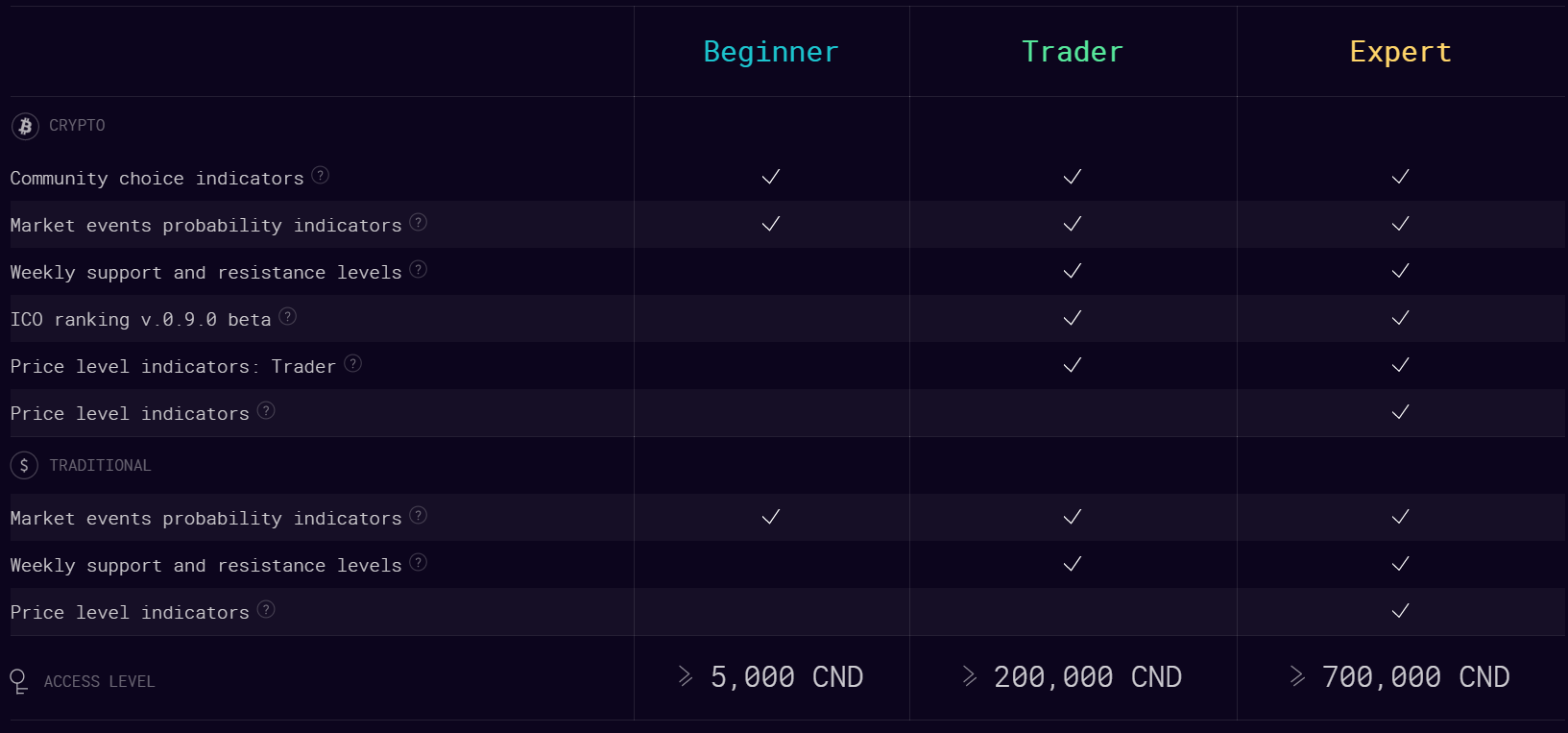

Depending on how many Cindicator tokens a community member holds, s/he can access the platform’s analytical products, indicators, trading signals, and rating system. This includes probability indicators for market events, market indices, market analysis, and trading resources like bots and APIs.

Some concrete examples of these services include the Cindicator Bot 1.0 and the Cryptometer Bot 2.0. These bots provide their users with real-time trading indicators, time-sensitive market alerts, and asset ranking among other benefits.

Token holders are able to access more complex services based on their stake in Cindicator via the CND token. Token holders pay a performance fee relative to the success of Cindicator’s predictive analysis. These fees are then allocated to funding pools that go towards the payment of the Collective Intelligence Platform’s forecasters. Additionally, these pools are replenished from the company’s investment portfolio based on its machine learning models as well as user payments for specific trading tools and analytics.

Cindicator Markets

Coming out of its ICO in September, Cindicator had a relatively tame market birth, bouncing between $0.01-$0.02 for the majority of Q4 2017. It took a beating in January during the New Year correction, falling to $0.05 from an all-time high of $0.20 on January 7th.

It bounced back quickly, though, and it’s sitting at a comfortable $0.23 at the time of this writing after touching a new all-time high of $0.33. This price spike has the asset encroaching on the top 70 after breaking into the top 100 just last week.

Where to Buy, Where to Store

Cindicator currently trades on Binance, HitBTC, and Mercatox for BTC and ETH, though Binance accounts for more than 96% of the total trading volume (78.13% for BTC and 18.41% for ETH).

The coin is an ERC20 token, so any ERC20 compatible wallet ought to have you covered, such as MyEtherWallet, Meta Mask, or Parity. If you have a Ledger Nano S or a Trezor, those work too, and we recommend these as the safest storage option.

Originally Posted at CoinCentral.com

Add Comment